For the first time since November 2021, home sales in Northern Virginia increased over the same month in the previous year in February.

Sales were up 2.2% from February 2023, according to the Northern Virginia Association of Realtors. In addition, the total sold dollar volume jumped 16.3% as prices have remained high.

“Spring is always strong for the Northern Virginia real estate market, but this one is looking particularly positive as we are seeing more listings coming on the market as compared to a year ago, and those who are buying are willing to spend a little more,” said NVAR board member David Raffinengo with KW Metro Center. “People are getting over the mortgage rate sticker shock, and with the potential for rates easing more, I believe we will see even more sellers willing to put their houses on the market.”

Overall, home sales were up from the previous February as well as this January. Supply remained tight at 0.9 months but was slightly up from the 0.8 months supply in February 2024 and was also higher than the average over the past five years.

Houses also sold quickly, staying on the market only 22 days, down 31.3% from February 2023. High demand continued to push prices up. The median sold price for a home in February reached $687,250, up 11.8% from February 2023.

“The hint of spring is getting more homeowners ready to sell, which is good news for those who have been wanting to buy. Exceptionally high demand continues to push prices higher as sellers receive multiple offers. I am excited by the growth in sales, volume and inventory. This could be a step toward a more normal and healthy housing market,” said Ryan McLaughlin, CEO of NVAR.

The NVAR report covers home sales activity for Fairfax and Arlington counties, the cities of Alexandria, Fairfax and Falls Church and the towns of Vienna, Herndon and Clifton.

Here are other highlights of the February 2024 report, compared to February 2023:

- Closed sales: 1,020 units, up 2.2%

- Total sold dollar volume: $841,159,072, up 16.3%

- Average sold price: $830,840, up 14.5%

- Active listings: 1,153, down 6.6%

- New pending sales: 1,177, down 2%

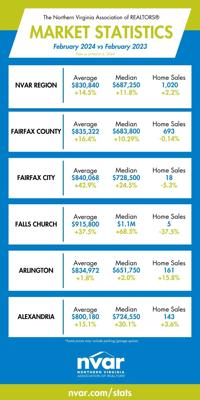

Here are details on sales by jurisdiction in February:

February 2024 home sale statistics in Northern Virginia by jurisdiction.

(10) comments

Real estate in this area continues to hold its value unlike much of the rest of the Country. We are and will likely continue to be a good investment. All new builds sell quickly. We will likely not see a downturn, even when the economy cools.

People who invested in "hot" Florida and Tennessee markets during the Pandemic are regretting their choices. Those markets are projected to lose 30%+

The median family in Northern Virginia does not have enough income to qualify for a loan on the median home price. That is not a healthy situation.

Yet according to Pearson Smith Reality there are five qualified buyers for every house listed on the local market.

You think that's a sign of a healthy economy? That's simpleton thinking. There is a shortage of homes on the market because people don't want to give up their low mortgage rates. The average Northern Virginian isn't even considering buying now because they won't qualify to buy a home in a decent or semi-decent neighborhood.

"Real estate in this area continues to hold its value unlike much of the rest of the Country."

Then you need to get out more. Midwestern markets are on fire right now and rural counties in states bordering metro areas are some of the hottest I've seen in decades thanks to hybrid/remote work. My rural home is outperforming my NoVA properties.

DC will continue to be a good investment because the federal government never has a "downturn" like real industries do. When you're operating at multi-trillion dollar deficits and one of your largest expenses is the interest you pay on your own debt, you've pretty much given up the illusion of fiscal responsibility. Might as well ride it for as long as you can and make some money in the process.

Really?

Start naming zip codes that are doing better than DC.

DC is a lot bigger than just Government. IT, Professional Services, etc.

Doing better how? YoY appreciation? Because if that's what you're asking for, there are too many to list.

https://sparkrental.com/hottest-real-estate-markets/

No. YoY appreciation is a measure of hot (bubble) markets.

Give me zip codes of places with prices x2 or more of the national average with consistent growth since 2010. What I would call "blue chip" real estate. Not speculative markets.

Also a "better" zip code should include median income, life expectancy, educational achievement and other markers of success.

"No. YoY appreciation is a measure of hot (bubble) markets."

Not every hot market is a bubble. DC will always be a strong market due to the federal government.

"Also a "better" zip code should include median income, life expectancy, educational achievement and other markers of success."

If those were metrics people cared about, Fairfax County wouldn't be losing people YoY to my "dying" rural county.

@ John.

Name your rural county. I bet it is not a successful as you claim.

I have already told you I live in Ashburn. So everyone can verify I live in a successful area. Ironically one with lots of data centers.

Your turn.

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.